Aramex - Turkey Shipment & Clearance Reminder

Content summary

(1) What is Identity Verification for Turkey Customs?

(2) What are the required Info for Individual Receiver & Company Receiver?

(3) How to Submit Info on Aramex KYC Website

Personal receiver

Company receiver

(4) Aramex Turkey different clearance arrangement base on "Declared Value"

If declared value over 150 EUR

If declared value 150-1500 EUR

(1) What is Identity Verification for Turkey Customs?

Base on Turkey clearance policy, any shipment imported to Turkey, the receiver must complete identity verification before clearance. In other words, Turkey customs needs to verify the receiver's identity by checking the personal ID certificate to ensure the safe and valid importation.

(2) What are the required Info for Individual Receiver & Company Receiver?

|

Identity |

Required Info |

|

Personal─ Turkish Nationals |

(1) Name (Turkish: AdI) (2) Surname (Turkish: SoyadI) (3) Turkey Personal ID No (Turkish: TC(Yabanci) Kimlik) |

|

Personal─ Foreigners Living in Turkey |

(1) Name (Turkish: AdI) (2) Surname (Turkish: SoyadI) (3) Turkey Residence Permit No (Turkish: Oturma izni numarası) |

|

Company |

(1) Company Name (Turkish: Şirket Adı) (2) Turkey TAX ID (Turkish: Vergi Numarasi) |

⚠️ Attention

.The receiver's identity is based on "the receiver name" stated in the shipping label. For example, if the receiver identity is a "company", the receiver's name should be company name and vice versa.

.Before shipping, please reconfirm the receiver's identity to avoid any delay due to changing the identity during clearance. Customs has the authority to directly return shipment and refuse the request to change the identity. All the charges triggered by parcel return will be billed back to shipper.

(3) How to Submit Info on Aramex KYC Website

⚠️ Attention

Example link:https://www.aramex.com/tr/en/know-your-customer?q=XXXXXXXXX

The website address codes behind "q=" will differ on every tracking number

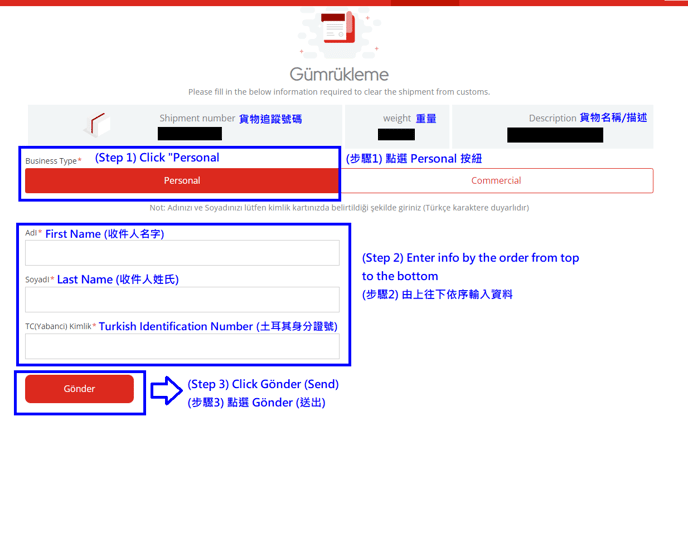

【Personal Receiver】

.Go to website, click "Kişisel/ Personal"

.Enter the info with receiver's name, last name, and Turkey ID number

.Click "Gönder" to submit the info

【Company Receiver】

.Go to website, click "Ticari / Commercial"

.Enter the info with company name and Turkey TAX ID

.Click "Gönder" to submit the info

(4) Aramex Turkey shipment clearance rules on "Declared Value"

If shipment declared value is over 150 EUR

- the receiver must contact Turkey Aramex to complete the brokerage-transferring documents

- the shipment is over the duty/tax free limitation. Thus, the receiver must settle the duty/tax payment.

Turkey Aramex contact:

Phone number: (+90) 2129991222

Opening Hours: Mon.~ Sat. 8:30 am~6:30 pm

- it must go through the formal import customs clearance procedure

- Turkey Aramex won't assist the process and the receiver must find his/her assigned local brokerage company to complete the clearance

- After checking, Turkey Aramex will deliver the original documents to the receiver's assigned brokerage and accordingly transfer the brokerage right to it

- Once process is completed, Aramex website will show "Clearance Documents Handed to Customer for Self-Clearance and Delivery", which is the final update provided on the Aramex online tracking for this shipment

- For any other delivery and clearance details, receiver must check with his/her assigned brokerage

(5) Final Reminder

- Fail to submit the consignee’s Turkey personal ID number, residence permit number, Tax ID number, or any other required identification forms will result in delays in clearance and delivery

- Although the importer is required to submit identity certificates, it doesn't mean all of the parcels can be cleared by this method. For the restricted shipments regulated by Turkish customs policy, the importer must submit the import permits on top of identity certificates for clearance. Shipment will not be released until customs approved. Also, prohibited items are unable to import no matter if importer submit identity certificates or not.

- If any questions, please contact customer service team

Last update: 31 May 2023