Notice for Shipment to India─ What is KYC Documents

(1) What is KYC Documents

Explanation: KYC is the acronym for "Know Your Customer", which indicates the official certificate of identity and address. KYC further classifies as "Individual KYC" and "Company KYC". For all shipments exported from and imported into India, the importer / exporter must submit KYC documents as per Indian Customs policy (CBEC circular no. 9/2010) as the certificate during clearance.

(2) Table of Required Documents for Individual KYC & Company KYC

|

Identity |

Notice |

Required Documents |

|

Individual─ Indian Resident |

*(A) PAN card (Permanent Account Number) should be accompanied by one of the below documents with clear front and back images as supporting certificate. (1) Aadhar Card (2) Passport (3) Voter ID Card (4) Driving License

*(B) Address on KYC should match with shipment address. (Note) If KYC address is different from shipment address, please provide any one of the below supplementary document as address proof.

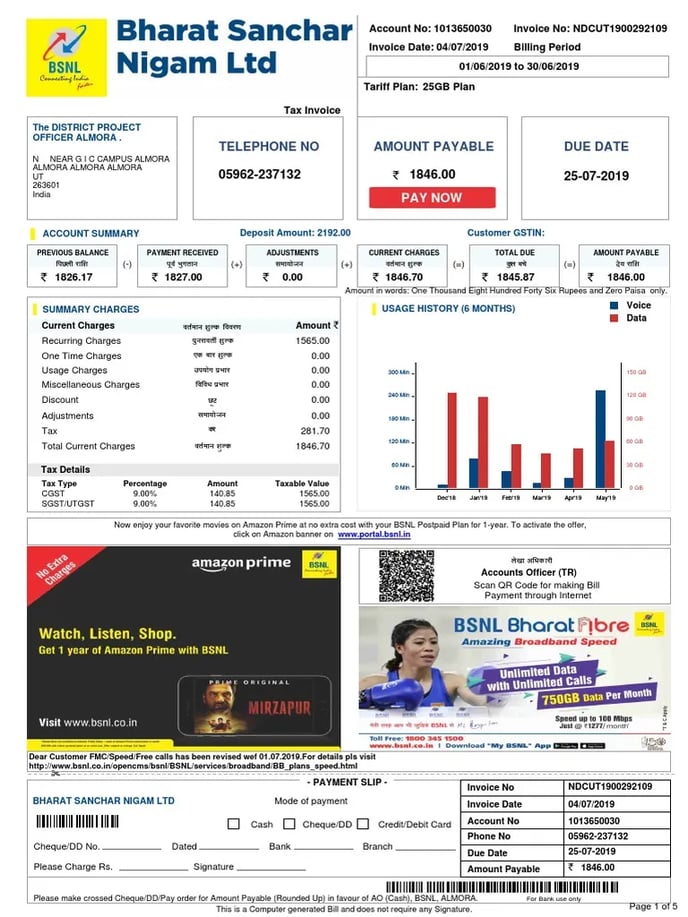

(1) Rent Agreement (2) Electricity Bill (3) Gas Connection Receipt (4) Bank Account Statement (5) Employee ID (6) Hotel Booking Receipt (7) Hostel ID card / College ID with Hostel Fee Receipt (8) Telephone Bill (9) Ration Card (Note) : Above mention document should be on same name and address as mentioned on shipment.

|

(1) Aadhar Card (Front & Back Image) Category: Main Certificate

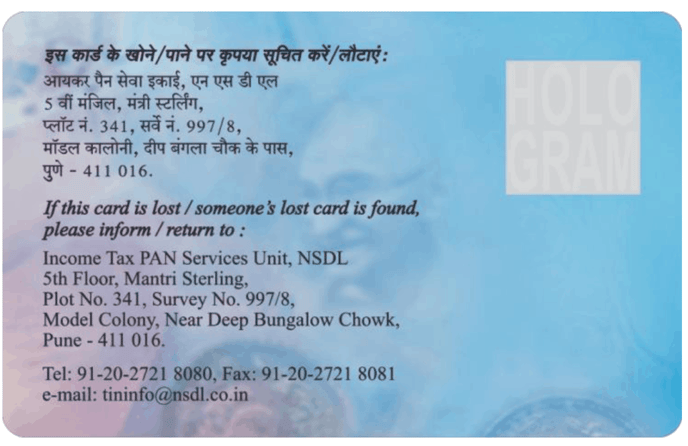

(2) PAN Card (Front & Back Image) Category: Main Certificate

(3) Passport – (Front & Back Image) Category: Supporting Certificate

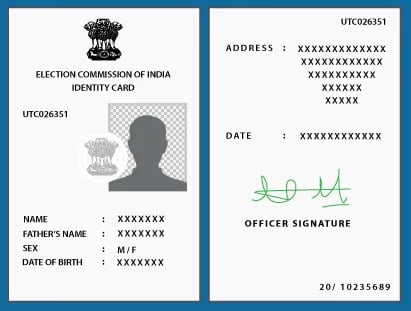

(4) Election / Voter ID Card – (Front & Back Image) Category: Supporting Certificate

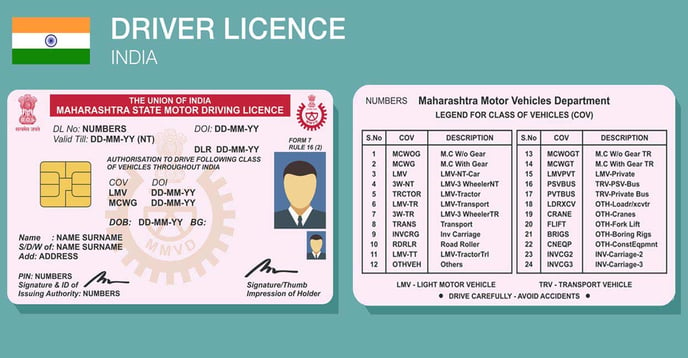

(5) Driving License Category: Main / Supporting Certificate

|

|

Individual─ Foreign Nationals Residing in India

|

N/A |

(1) Passport (Front & Back Image) (2) Visa / PIO (Person of Indian Origin) Card

|

|

Company |

IEC is mandatory and should be accompanied with any one of the rest. |

(1) IEC Number (Mandatory) (Import Export Code) (2) GST Number (Goods and Service Tax Number) (3) PAN Number (Permanent Account Number) |

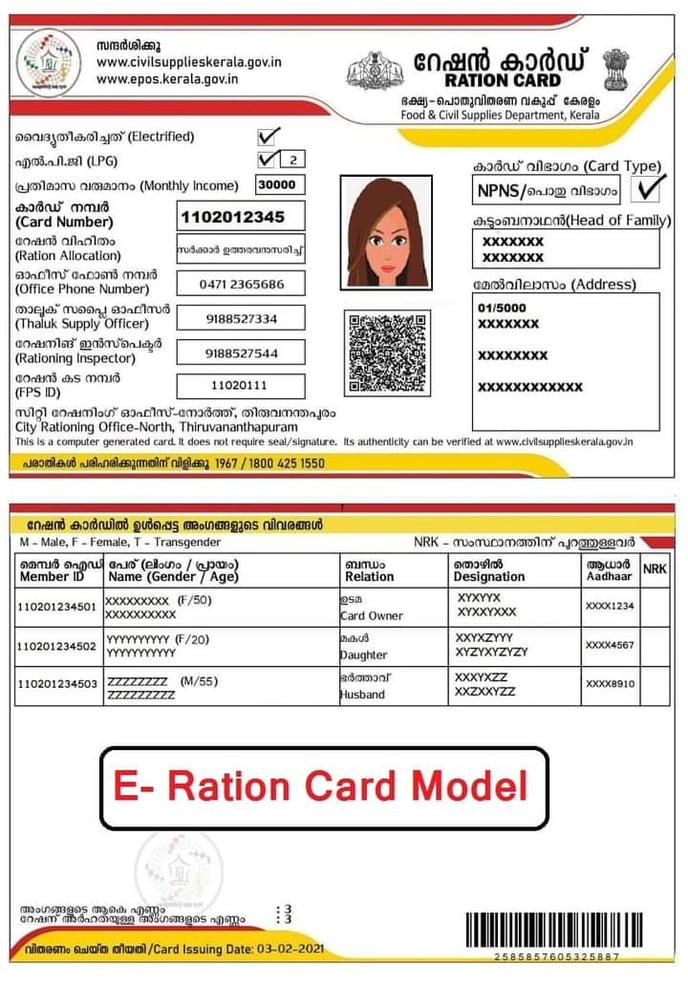

(3) Sample Pictures of Individual & Company KYC

(A) Individual KYC

(1) Aadhar Card

(2) PAN Card

(3) Election / Voter ID Card

(4) Driving License

(5) PIO (Person of Indian Origin) Card

(The gray certificate in the picture)

(6) Telephone Bill

(7) Ration Card

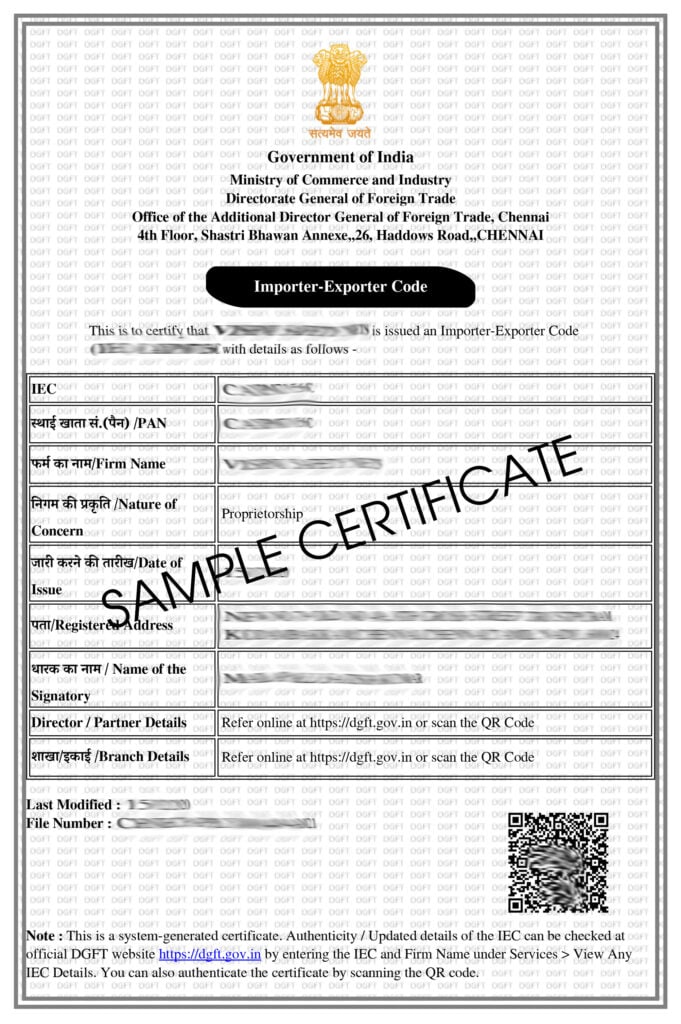

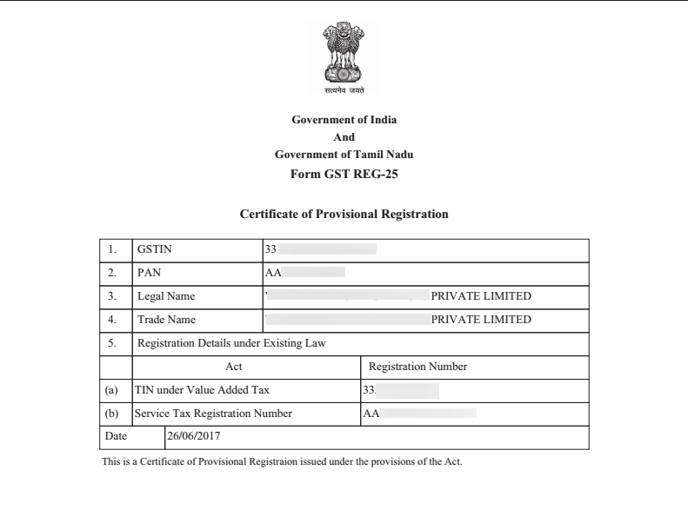

(B) Company KYC

(1) Import Export Code, IEC Number

(2) Goods and Service Tax Number, GST Number

(4) Import Notice