Understanding Duties & Taxes

Customs authorities collect duties and taxes on goods entering and leaving a country. It's important to understand the difference between "duties" and "taxes" in the context of shipping.

This page covers the following topics:

- What is the difference between tax and duty?

-

Are duty, tax, and customs handling fees included in the shipping fee?

-

If the shipment is a gift, do I need to pay duties and taxes?

-

Do I have to pay duty and tax for "forced return" shipments?

What is duty?

Customs duty is a type of tax on cross-border goods. It's collected by customs as government revenue and to protect local industries.

What types of duties are there?

Common examples include anti-dumping taxes, trade tariffs, export duties, and excise duties. They're mostly in the form of import duties, which apply to goods entering a country.

What is tax?

It's a government fee placed on purchased goods coming into a country (imported). Even though the goods have been purchased abroad, this consumption tax still applies and must be collected by customs when goods enter a country.

What types of taxes are there?

Sales tax, value-added tax (VAT), and goods and services tax (GST) are practically the same thing, however the name and rate vary by country. Example tax rates can be 0%, 10%, 20%, or more, depending on the country and product.

What is the difference between tax and duty?

Duty is a fee charged on certain imported or exported goods, while tax is a fee charged on a wide range of goods, services, and transactions.

What are duties and taxes based on?

The amount of duties and taxes you need to pay for a shipment is determined by several factors:

- Reasons for export; e.g. business use, gift, return items

- Country of manufacture

- Contact information of the sender and recipient

- Good descriptions; e.g. 1 men cotton t-shirt, 2 pairs of cotton socks

- Harmonized Commodity Description and Coding System (HS code)

- The value of the good

- Freight and insurance fee

- Country-specific regulations

Given the information provided, the customs authorities can apply relevant duty and tax. To make sure the goods are classified correctly, the information provided should be accurate, as well as the HS code and goods description should match.

How to calculate duty and tax?

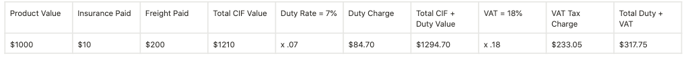

There are generally two methods for calculating duty rates: CIF and FOB. VAT (Value Added Taxes) are generally applied to the CIF or FOB + Duty value.

-

FOB

It stands for “Free On Board”. In this case, the taxable value is the value of the product.

-

CIF

It stands for “Cost, Insurance, and Freight”. In this case, the taxable value includes the item value, cost of insurance (if any), and transportation cost to the final receiver.

Are duty, tax and customs handling fee included in the shipping fee?

No, the shipping charges collected are transportation costs only. International shipments are still subject to duty, VAT taxes, and custom fees, which can vary from country to country. You can contact us to get an idea of estimated extra cost.

In most cases, the courier will clear your order through customs and collect the duty and taxes with an additional surcharge.

Who should pay the duties, the sender or the recipient?

- For personal accounts, all parcels sent through Spaceship are automatically sent on Delivery Duty Unpaid (DDU) terms. This means that the recipient will pay the duty, tax, and customs clearance fee when the parcel arrives in the destination country.

- For business accounts, you can select Delivery Duty Unpaid (DDU/DAP) or Delivery Duty Prepaid (DDP) according to your requirements. If you select DDP, Spaceship will charge back the duty, tax, and customs clearance fee from carriers. Typically, it takes the courier 4-8 weeks to charge back the tax to your account. In some cases, the courier may issue the invoice even after 4-8 weeks, especially from developing countries like Indonesia and Malaysia.

- If the duty and tax are not settled, the parcel will be rejected entry by customs and forced to return at extra cost. The sender will bear the final liability for unpaid tax, customs clearance fee, and return fee.

- In rare cases, the Spaceship account user may be invoiced beyond 8 weeks, as Customs has the right to adjust the import tax within three years. The courier will not be liable for any customs tax and fee, so the customs fee should be charged back to the shipper or Spaceship account owner.

Learn about how to choose between DDP and DDU in this article.

If the shipment is a gift, do I need to pay duties and taxes?

Yes, even if a shipment is a gift, it must still go through an import procedure as determined by customs law in the destination country. Tax amount is determined by a variety of factors, not just the purpose of it. The general rule is that any gift is a taxable gift with a fair market value.

If you wish to declare a shipment as a gift, the following conditions should be met:

- The item description should include the reason for the gift (e.g. "birthday gift" for a plastic phone case or "Christmas gift" for silver earrings).

- The shipment should be bought and sent between individuals (not companies).

- It should be intended for personal use.

- It should be sent between two private individuals.

- It should be sent on a single occasion, for a birthday, anniversary, or other occasion.

- It should be sent without payment by the recipient.

- It should only be for private use.

- It should be valued lower than the tax-free threshold in the importing country.

- The same recipient should not receive more than a certain value of gift on each day.

- It should not include goods subject to special rules (e.g. spirits, wine, tobacco, or perfume).

If any one of these conditions is not met, then the importer is obliged to pay the full rates of duty and tax applicable for the product contained in the package.

Do I have to pay duty and tax for return or repair item?

Yes, you do. Return items must be provided with the correct HS code, reason for import, descriptions, proof of shipping, and proof of return. The declaration must use the appropriate HS code suffix for return purpose. It may be practically uneasy to meet all requirements. Additionally, most carriers do not support special customs requests.

Do I have to pay duty and tax for "forced return" shipment?

Yes, you do. Under the following circumstances, the shipper will bear the duty and tax instead of the recipient, even if the order is shipped at DDU/DAP term.

- The shipper requests a return for an undeliverable shipment.

- The consignee refuses to pay the import tax.

- The customs refuses to release the shipment, mostly because of mis-declaration, undervalued declaration, missing proper import license/document, or unsettled duty and tax.

The incurred tax will be billed to the shipper as the recipient fails to fulfill their obligation.