Spaceship Air : Elevate Your eCommerce Experience

Enjoy favorable price, reliable service and full end-to-end online tracking.

About Spaceship Air

Spaceship Air provides extensive delivery coverage in Americas, Europe, Asia and Middle East. It is designed to serve eCommerce customers who desire affordable, reliable and regular tracking solution for small parcels. The parcels will be shipped by air, then injected into the local postal or courier service for final mile delivery. Tracking is available from end to end.To explore the specific section that interests you, please follow the link below.

- Service Options

- Chargeable Weight

- Transit Time

- Delivery Coverage Limitation

- Key Tracking Events

- Size Limitation

- Customs Clearance - America

- Customs Clearance - Europe

- Customs Clearance - Asia

- Customs Clearance - Middle East

- Failed Delivery Arrangement

- Additional surcharge

- Claim Support Guide

- Prohibited Item List

Service Options

| Service Name | Destination Countries |

| Spaceship Air Premium (Tax-Inclusive) | United States |

| Spaceship Air Express (Tax-Inclusive) | United States |

| Spaceship Air Standard | United States, Canada, Australia, European Union Countries, New Zealand and United Kingdom |

| Spaceship Air Economy | United States, Canada, Mexico, Australia, New Zealand, European Union Countries, United Kingdom, Singapore, Japan, Chile, Columbia and Brazil |

Chargeable Weight

| Service Name | Chargeable Weight |

|

Spaceship Air Economy (Tax-Inclusive) Spaceship Air Express (Tax-Inclusive) |

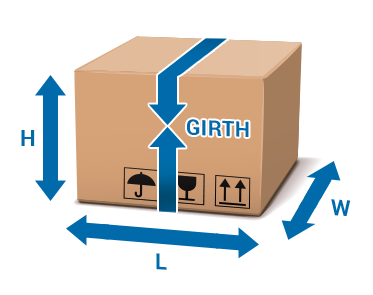

Spaceship will charge based on the greater of actual weight or volumetric weight. Volumetric weight = W x L x H cm/8000 for most destinations. Spaceship will charge based on the nearest 50g (rounded-up). |

| Spaceship Air Standard | Spaceship will charge based on the greater of actual weight or volumetric weight. Volumetric weight = W x L x H cm/6000. Spaceship will charge based on the nearest 10g (rounded-up). |

| Spaceship Air Economy |

Spaceship will charge based on the greater of actual weight or volumetric weight. Volumetric weight = W x L x H cm/8000 for most destinations. |

*To determine the dimensions of the parcel, we measure the widest point of the package.

Transit Time

| Destination Country | Transit Time (Working Days) |

| United States |

Spaceship Air Express (Tax-Inclusive): 5 - 9 working days, additional time to remote area Spaceship Air Standard & Spaceship Air Economy: 7 - 12 working days, additional time to remote area |

| Canada, Mexico | Spaceship Air Standard: 7 - 10 working days, additional time to remote area Spaceship Air Economy : 9- 13 working days, additional time to remote area |

| Australia | 7 - 11 working days, additional time to remote area |

| Japan | 7 - 10 working days, additional time to remote area |

| Singapore,Malaysia, Philippines, Thailand, Vietnam | 4 - 9 working days, additional time to remote area |

| New Zealand | Spaceship Air Standard: 7 - 9 working days, additional time to remote area Spaceship Air Economy: 9- 16 working days, additional time to remote area |

| United Kingdom | 6 - 10 working days, additional time to remote area |

| European Union Countries | 6 - 10 working days, additional time to remote area |

| Brazil | 16 - 26 working days, additional time to remote area |

| Chile | 11 - 18 working days, additional time to remote area |

| Colombia | 12 - 20 working days, additional time to remote area |

| Israel, Saudi Arabia, Turkey and United Arab Emirates | 7-11 working days, additional time to remote area (Israel : The location is a self-pickup service) |

Delivery Coverage Limitation

For all destinations, Amazon warehouse addresses and military address are not accepted.

| Destination CountryNo Service Area | |

| United States |

We do not provide service to the following addresses: Remote area surcharges is implemented for Spaceship Air Economy. Please refer to the additional surcharges. |

| United Kingdom |

We do not provide service to British Indian Ocean Territory, British Virgin Islands, Guernsey and Jersey. |

| Sweden, Denmark, Finland, Lithuania, Estonia |

This information is specifically relevant to shipments using Spaceship Air Economy. Some last-mile service providers only offer self-pickup options (such as self-pickup points or delivery lockers) for this particular service. To ensure successful delivery, it is essential for the recipient to provide precise and comprehensive contact information. Failure to do so may result in unsuccessful delivery. |

| Poland |

Only the following 4 cities can accept packstation address: Warsaw, Wroclaw, Poznan, Krakow;Packstation maximum size and weight limit: 60x35x40cm and 25KG |

| European Countries |

We do not provide services to islands affiliated with Europe. Please refer to the undeliverable area list for more details. |

| Israel |

Gaza is out of reach. The location is a self-pickup service, with a weight limit of 5 KG and dimensions of 454040 cm for the pickup point. |

Key Tracking Events

The following key events are traceable on the tracking URL generated. In practice, there will be more events to regularly update the shipment progress.

1. Pickup Scheduled

2. Arrived Spaceship Warehouse

3. Processed at origin hub

4. Uplifted

5. Arrived at destination airport

6. At customs (if goods are held in customs)

7. Arrived at destination processing facility

8. Tendered to final mile carrier

9. In transit

10. Out for Delivery

11. Delivered

Spaceship Air Express (Tax-Inclusive) & Spaceship Air Premium (Tax-Inclusive) - Size Limitation

| Destination Country | Size Limitation |

| United States | Min 10x15cm , Max 55 x40x35cm |

Spaceship Air Standard - Size Limitation

| Destination Country | Size Limitation |

| United States | Min 10x15cm , Max Length ≤66cm, L+Girth ≤213cm |

| Canada | Min 10x15cm, Max Length ≤200cm, L+Girth ≤ 300cm |

| Australia | Min 10x15cm, Max Length ≤100cm, Volume≤0.25m3 |

| New Zealand | Min 10x15cm, Max Length ≤150cm, Volume≤0.125m3 |

| United Kingdom | Min 10x10cm, Max: 60 x 40 x30cm |

| European Countries | Min 10 x 15cm, Max 60 x 40 x 35cm |

* For shipments over the max limitation, pre-approval is required. It is subject to the oversize handling surcharge

Spaceship Air Economy - Size Limitation

| Destination Country | Size Limitation |

| United States | Min 10x15cm , Max 55 x40x35cm |

| Mexico | Min 10x15cm, Max 60x50x50cm |

| Japan | Min 10x15cm, Max 59x49x39cm |

| New Zealand | Min 10x15cm, Max 59x50x40cm |

| Netherland, Germany, Belgium, Luxembourg, Ireland, Sweden, Norway |

Min 10x20cm, Max length ≤ 45cm, |

| Switzerland | Min 10x15cm, Max length + width + height ≤ 90cm, Longest side ≤ 60cm |

| United Kingdom | Min 10x15cm, Max 60x40x30cm |

| Other European Countries | Min 10x15cm, Max 60x40x35cm |

| Chile, Brazil | Min 10x15cm, 10cm≤ length of one side ≤100cm |

| Columbia | Min 10x15cm, the maximum dimension for one side should be no more than 50cm, and the three sides should not exceed 150cm. |

| Israel | Min 10x15 cm, with L + H + W ≤ 120 cm, and the longest side ≤ 60 cm. |

| Saudi Arabia | Min size 10x15 cm, with dimensions 120 cm x 50 cm x 50 cm, where one side does not exceed 120 cm. |

| Turkey, United Arab Emirates | Min size 10x15 cm, with length + width + height ≤ 220 cm, and the longest side ≤ 150 cm. |

| Other Countries | Min 10x15cm, Max 60x40x35cm |

* For shipments over the max limitation, pre-approval is required. It is subject to the oversize handling surcharge.

*Girth measurement:(Height + Width)X 2

Customs Clearance

Americas

|

Destination Country |

Duty and Tax payment |

| United States | Shipments using all types of Spaceship Air Service are delivered with Delivery Duty Paid (DDP) terms. It is important to note that shipments with a value exceeding USD250 will not be accepted. |

| Canada | For Spaceship Air Standard, there is no value limitation. However, for Spaceship Air Economy, the declared value should be less than USD 99. It is important to note that if the declared value exceeds 20CAD (about USD 15.5), Spaceship will apply a DDP charge of 10% of the declared value plus a 2% handling fee. Providing detailed information about the material of the product is crucial for accurate tariff calculation. For instance, if you are shipping plastic toys, ensure to include this information in the declared product name to prevent delays in the shipment process. |

| Mexico | Delivery Duty Paid (DDP) will be applied, with a 19% tariff charged on goods valued at USD 50 or higher. |

| Brazil | Delivery Duty Unpaid (DDU) will be implemented, requiring the recipient to provide their tax ID. If the package's declared value falls within the range of 50 to 3000 US dollars, the recipient will be responsible for paying 60% of the total tax amount based on the declared value. It is crucial to note that packages weighing over 3.5KG must have a declared value exceeding 50 US dollars to ensure smooth delivery process. |

| Colombia | Delivery Duty Paid (DDP) service is available. If the package's declared value is below 200 US dollars, no VAT or customs duties are required. However, for packages exceeding 200 US dollars, Spaceship will impose a 10% customs duty and a 19% value-added tax based on the declared value. Additionally, a handling fee of 2% of the declared value will be applied. |

| Chile | Delivery Duty Paid (DDP) is enforced for shipments in Chile. Chile is set to implement a VAT policy adjustment on October 25, 2025. For imported goods valued at less than 500 US dollars, a standardized VAT rate of 19% will be applied (duty-free), calculated as VAT = CIF * 19%. |

**If the recipient's name and address are the same, and the total declared value of the package on that day exceeds the tax-free threshold, our company will collect the additional tax that is generated.

Europe

|

Destination Country |

Duty and Tax payment |

| United Kingdom | Delivery Duty Paid (DDP) only applies. Shipments with a value less than GBP135 are accepted. |

| Noway |

Shipments with a declared value of 3000 NOK or more (approximately 250 euros/265 US dollars) will not be accepted. In accordance with Norway's customs policy effective January 1st, 2024, it is essential to declare taxes and fees using the locally registered VOEC number. In cases where the declared value exceeds 3000 NOK, the customer will be responsible for any additional costs and potential customs clearance issues arising from inaccurate VOEC information provided. |

| Switzerland | Delivery Duty Paid (DDP) only applies. Starting from January 1st, 2024, Swiss Customs will make adjustments to the taxable value and VAT rate. It is important to note that the total declared value of packages sent to the same recipient should not exceed 62 Swiss francs per day (equivalent to approximately 66 USD). In case the cumulative declaration exceeds or equals 62 Swiss francs, the customer will be required to pay the VAT at a rate of 8.1%. Additionally, customs duties will be determined by the customs. |

| European Union Countries | Shipments with a value exceeding EUR150 will not be accepted. IOSS number is required. In case the IOSS number is not provided, the shipment will be on DDP term with an IOSS 2% handling fee. |

**If the recipient's name and address are the same, and the total declared value of the package on that day exceeds the tax-free threshold, our company will collect the additional tax that is generated.

Asia

|

Destination Country |

Duty and Tax payment |

| Japan |

Delivery Duty Paid (DDP) terms apply for shipments with a maximum value at 10,000 yen. Please take note that we accept general goods, clothing, and textiles. Clothing category: male/female + fabric material + weaving method + clothing style. Example1: Women's cotton woven one-piece Example2: Men's cotton knitted sweatshirts |

| Australia | Only DDP is accepted. Formal customs clearance fees are required for mail items valued over 1000 Australian dollars. |

| New Zealand | Only DDP is accepted. Formal customs clearance fees are required for mail items valued over 1000 New Zealand dollars. |

Middle East

|

Destination Country |

Duty and Tax payment |

| Israel | Only DDP is accepted.

We do not accept goods with declared values over $75 USD or shipments exceeding 5 items. Misdeclarations are strictly prohibited, and any costs incurred will be the customer's responsibility. Due to strict regulations in Israel, the inspection rate for wireless signal products and automotive accessories is very high. Recipients must provide relevant permits for clearance. Parcels not cleared within 3 days may incur warehousing charges, and inspected packages may also face these fees. Taxes may apply based on the declared value, and Spaceship reserves the right to pass on warehousing fees and taxes to senders. These charges are based on actual costs and may not include documentation. To avoid high warehousing fees, notify customs if the sender does not intend to continue with the clearance process. Customs will assume disposal if no action is taken. Products requiring communication permits include: car Bluetooth, home routers, wireless chargers, phones, digital watches, cellular modems, tablets, computer equipment, projectors, gaming consoles, GPS devices, e-books, and more. |

| Saudi Arabia | Only DDP is accepted.

|

| Turkey | Only DDP is accepted.

|

| United Arab Emirates | Only DDP is accepted.

|

**If the recipient's name and address are the same, and the total declared value of the package on that day exceeds the tax-free threshold, our company will collect the additional tax that is generated.

Failed Delivery Arrangement

In general, Spaceship Air provides a single delivery attempt for each shipment. If delivery is unsuccessful, recipients are encouraged to retrieve their package from the nearest post office or courier station. For those requiring a redelivery, this option is available in selected countries under specific conditions. Please note that redelivery may take between 7 to 21 days to complete.

Spaceship Air Economy (Tax-Inclusive) & Spaceship Air Express (Tax-Inclusive)

Return to the origin country is not available.

If the last-mile courier returns the parcel to the local warehouse, our customer service team will contact the shipper via email to arrange redelivery. The redelivery period is 10 days from the date when the customer is notified of the return of the package, the customer can choose to re-delivery at additional cost within 10 days; if there is no reply within 10 days, the package will be destroyed by default. For details, please refer to additional surcharge.

Spaceship Air Standard:

If parcel is not successfully delivered, it will be returned to the local warehouse for destroy, and re-delivery or return to shipper service will not be provided.

Spaceship Air Economy:

Return to the origin country is not available.

If the last-mile courier returns the parcel to the local warehouse, our customer service team will contact the shipper via email to arrange redelivery. The redelivery period is 10 days from the date when the customer is notified of the return of the package, the customer can choose to re-delivery at additional cost within 10 days; if there is no reply within 10 days, the package will be destroyed by default. For details, please refer to additional surcharge.

Malta / Cyprus / Switzerland / Slovenia / Croatia: Re-delivery service is not available. In situations where parcels are unable to be delivered due to address problems or the recipient's absence, the default resolution will be to consider the parcel as abandoned by the recipient, and no compensation will be provided.

Related Links:

Additional surcharge

Claim Support Guide

Last Updated: 26 Nov 2025